We’re being made to look like fools, coming here and pretending to know what course the Fed should take, regarding monetary policy. Hell, the Fed doesn’t even know what is right from wrong. Should we “get in front” of prospective inflation through rate hikes? Isn’t it all so artificial, after all? If rates want higher, the market will send them higher.

In a world where the donkey punchers from Romania, a country filled from top to bottom with criminality, get to borrow at the obscene rate of just 2%, one must think to oneself that something is amiss here. Maybe all of the bearshitters around the active volcano are right and this economy is being held together with the scotched tape of the Fed and other central banks. Now if you knew that to be a fact, would you, knowingly, precipitate actions that would lead to its eventual unraveling?

Any sane person answered no to that question.

The truth is, all of the talk about Fed rate hikes are utter horseshit, as TLT prints above $130. The market will see your rate hikes, and raise you, by lowering them for you, whether you like it or not. The market is in control of rates; and for now, they want lower.

While all of this is happening, the market is bidding up obfuscation: biotech stocks.

No one can argue with words like “imagine”, “potentially”, and “forecasted profits” etc. The great biotech run is the sleight of hand, the proverbial parlour trick, to keep you entertained, all the while carnage wreaks havoc on the industrials. At the vanguard of this dismantling is America’s cherished oil and gas industry, gone by the horizontal wayside–courtesy of Saudi Arabia.

This is why non-profitable, non-health care related, stocks are underperforming. We are late in the bull cycle and if you haven’t got a company that is generating free cash flow, in any significant magnitude, there are sellers who will correct your ways in short order.

You want proof? How’s this for proof?

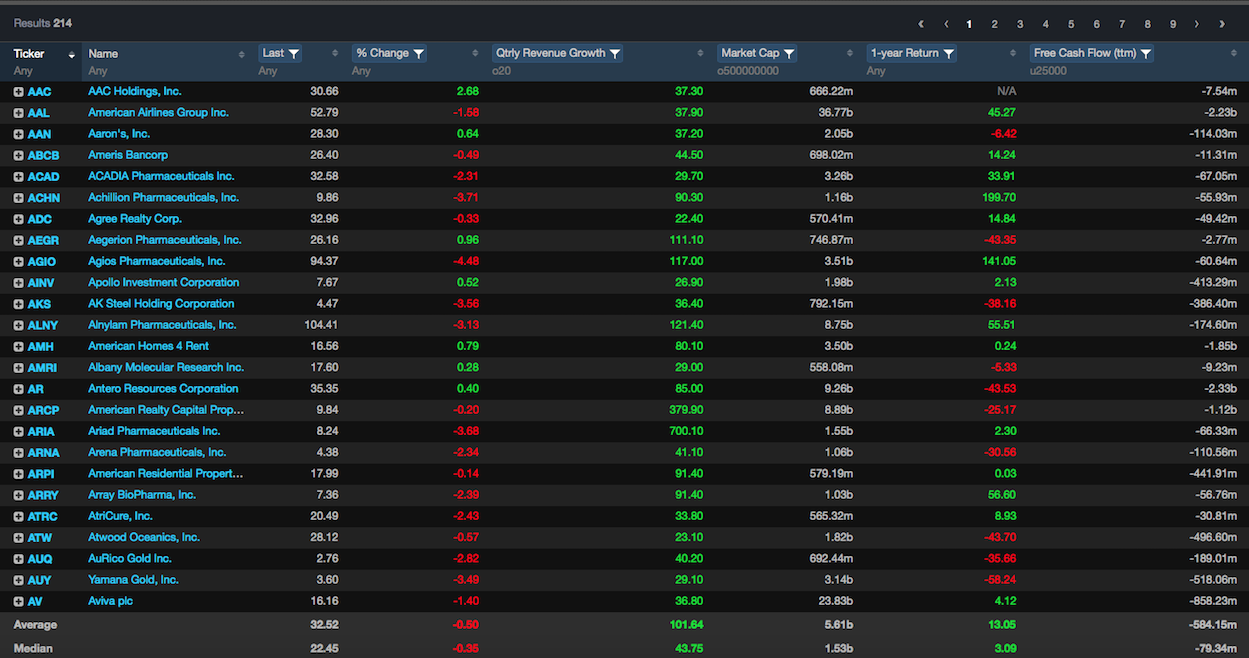

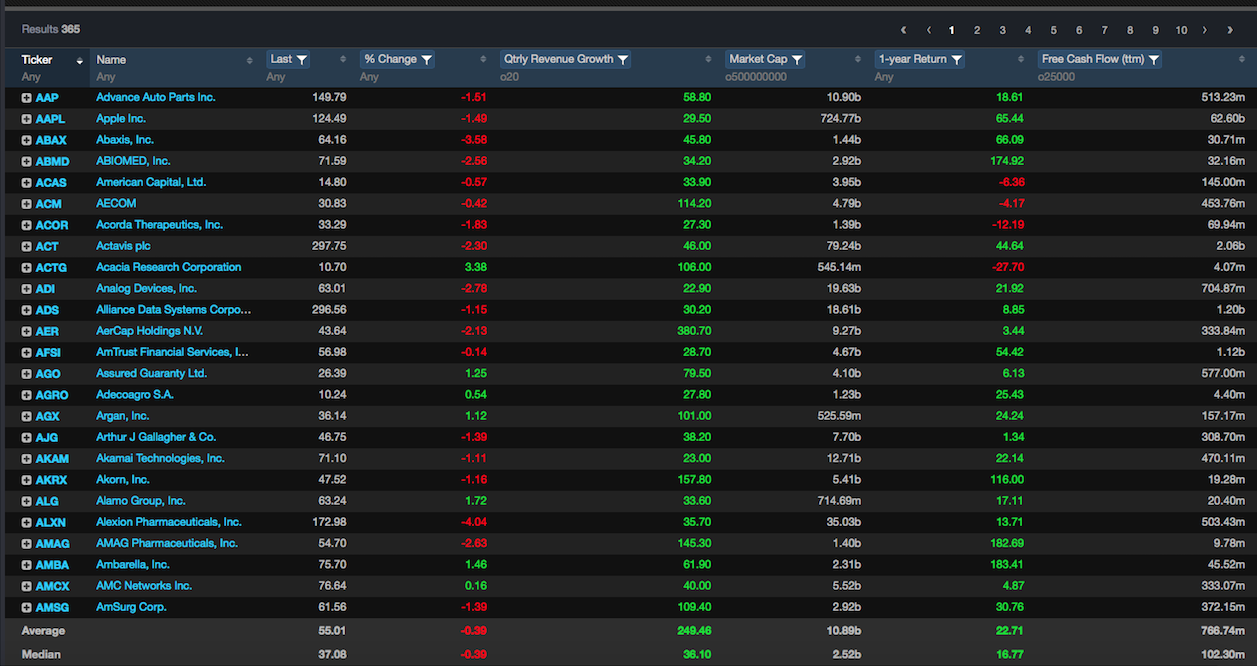

I ran two screens in Exodus, both identical except for one thing. In the first screen I asked for stocks with positive FCF, the second negative.

The free cash flow positive list netted more than 5x the percentage gains– over the past year.

Bear in mind, the latter screen of money losers includes all of the high flying biotechs, some stocks up 2,3, 500% over the past year. The results cannot be negotiated or glossed over any longer. Momentum is dead; long live free cash flow.

I suggest you start learning about the fundamentals of the market, on your own accord, else the forces of the market will make you do it under less agreeable terms.