From the New York Times:

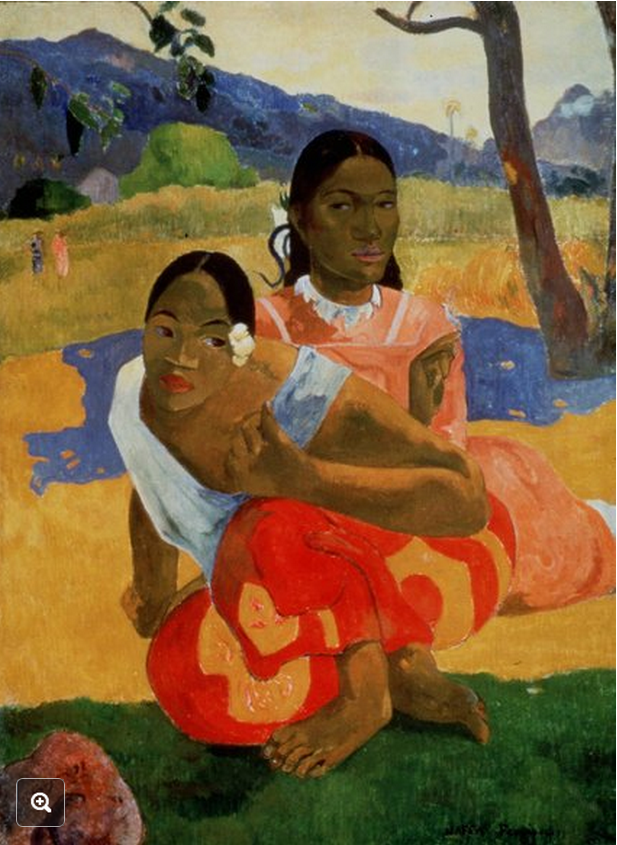

Guy Morin, the mayor of Basel, acknowledged news of the sale of the Gauguin and bemoaned its loss. On Tuesday, The Baer Faxt, an art world insiders’ newsletter, said Qatar was rumored to be the buyer of the Gauguin at $300 million, which would exceed the more than $250 million that Qatar reportedly paid for Paul Cézanne’s “The Card Players” in 2011.

So what do we make of all this?

1. Economics is about choices, mutually beneficial trades. The developed countries (I’ll call them “the West,” even though East Asia buys lots of the gas) swap art for gas. This is probably a good deal for the West from a utilitarian perspective, as the gas is worth far more than the difference in utility from looking at these paintings, as compared to other paintings that will replace them on the wall (and I’m saying this as a huge Cézanne fan.)

2. Or you can look at the labor involved in producing those 2 paintings, compared to the labor required to mine millions of tons of coal that would be burned, if we didn’t buy natural gas from Qatar.

3. On the other hand the labor criterion may be misleading. Suppose 10,000 artists each try to produce great paintings, knowing that each has a 1/10,000 chance of being the next Jeff Koons. All the failures earn zero, and the one success (Koons) makes $1 billion dollars. Ex ante, each artist might be willing to devote a lot of time on that lottery ticket to success. Yes, there is risk aversion to consider, but also the utility to be derived from the romanticism of struggling artistry.

4. So the huge expenditures on art by contemporary masters have a very large labor cost. But surely this doesn’t apply to dead artists? I’m afraid it does. While they were alive people were buying their art, hoping they’d be the next Van Gogh. Oil paintings are near infinite-lived assets. Even the purchase of paintings by dead artists is a spur to the contemporary art industry, just as the success of Facebook is a spur to the venture capital market of new social media companies trying to get going.

5. Does this trade increase inequality in the West? After all, millions pay gas bills to Qatar, and the money is then sent back to one rich guy in Switzerland. Yes, the refined taste of Middle Eastern royalty is making income in the West more unequal. In contrast, if Qatar had purchased 10,000 Mercedes with the $550,000,000, to be distributed to Qatari public employees, then lots of the money would have gone to workers in Germany—a more equal distribution.

6. But wait, those Mercedes have an opportunity cost. Western consumers don’t get to enjoy them. Measured consumption would be higher in the West if they swapped the paintings rather than the cars.

7. On the other hand, argument #6 is refuted by my earlier observation that the spur to the art market caused by this purchase leads young Germans into the art industry, instead of the technical schools training future Mercedes employees. Either way, roughly the same quantity of consumer goods is produced in the long run. The difference is that income inequality is greater if consumption tastes shift from a constant cost industry (cars) to a winner-take-all industry (art.)

PS. The Gauguin was on a semi-permanent loan to a Swiss museum, while the Cézanne was sold out of a private collection in Greece. Does that matter for equality? It depends what the Swiss seller does with the money. Do they spend it on something equally charitable to the loan of the painting?

HT: Lorne Smith