In response to Deflationary Trends in Consumer Credit, reader John, owner of 37 Fast Food restaurants writes …

Hi Mish

I wrote last month regarding Obamacare and how it’s influencing the unemployment rate.

Now that Obamacare is more firmly entrenched and the look back period has officially started, I see a lot of my fellow restaurant owners moving fast to hire part-time workers only. Keep your eye on the part-time increases in employment over the next year.

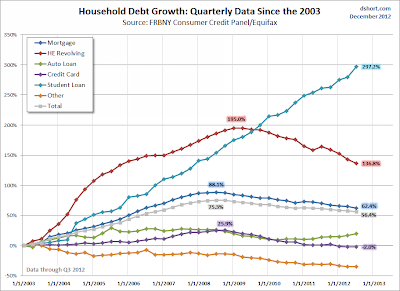

On another note, it would be interesting to see how student loan balances have gone up since 2004 compared to auto loans, credit cards and mortgages for the same time period.

John

Impact of Obamacare on Jobs

Please see Mish Obamacare Mailbag: Expect More Part-Time Jobs and how it’s influencing the unemployment rate] for a collection of reader emails, including one from John, regarding the impact of Obamacare on jobs.

Impact of Recession on Consumer Debt

John’s idea on charting student loan balances is an interesting one.

Doug Short at Advisor Perspective does a phenomenal job with charts and Doug was kind enough to chart the comparison of various consumer debt ratios two ways, per my request.

Household Debt Since 2003

click on either chart for sharper image

Household Debt Since Start of 2007 Recession

Fed data for the above charts is quarterly.

As you can clearly see: mortgage debt, home equity debt, auto loans, credit cards, and other miscellaneous debt is all down since the start of the recession.

Overall consumer debt is down 8.6% but student loans are up 74.6%. This is what happens when government purportedly attempts to find solutions to problems.

The result is education costs have increased unabated, and millions of students have been turned into debt-slaves for life in a game of Student Debt Lotto.

The deleveraging of consumer debt is by definition deflationary, as is turning students into debt slaves.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com